Gambling Dynamics Across Various Fields

Gambling, whether it involves the stock market, roulette, or sports, inherently starts with placing a bet. The primary challenge for both investors and gamblers is identifying bets that offer risk-adjusted returns and a positive expectancy. This article delves into the workings of the Kelly Criterion, a method used to determine the optimal portion of capital to risk in a bet.

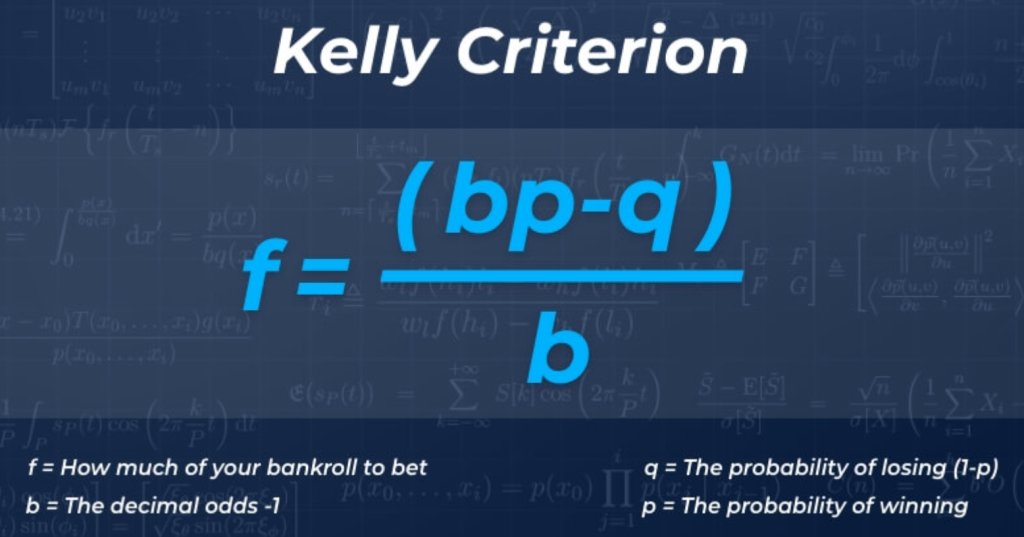

Understanding the Kelly Formula

In the realm of probability theory, the Kelly Criterion is recognized as a scientific method for gambling, also referred to as the Kelly formula, Kelly strategy, or Kelly bet. It’s a mathematical approach designed for sizing bets or investments in a way that maximizes wealth over the long term, proving more effective than any other betting strategy. The essence of the Kelly Criterion lies in its ability to size bets or investments that consistently lead to greater long-term wealth than any alternative strategy.

This gambling method can determine the optimum amount of money an investor or bettor can invest or wager on an opportunity. The bet size of the Kelly criterion is found by optimising the anticipated value of the logarithm of wealth, which is equal to maximising the expected geometric growth rate. With this strategy, users bet a predetermined fraction of assets while considering the amount of money available to use and the expected returns.

Application of the Kelly Criterion

The principle behind the Kelly strategy is quite straightforward: the size of a bet should be proportional to the likelihood of winning, adjusted by the probability of losing. It calculates the optimal bet size to maximize the chance of success. For instance, consider using a dice to demonstrate the Kelly Criterion staking method:

Suppose a dice has a 55% probability of landing on a 1, 2, or 3, and a 45% chance for 4, 5, or 6. The variables in the Kelly formula would be set as follows:

- P (probability of success) = 0.55

- Q (probability of failure) = 0.45 (1 – P)

- Based on the formula, the optimal fraction of the bankroll to wager (f) would be ( f = \frac{P – Q}{1} = 0.10 ) or 10%.

Kelly Criterion in Action: Sports Betting Example

In sports betting, the Kelly formula is used to prevent bankruptcy and sustain play. It calculates the ideal bet size relative to your total betting bankroll. For instance, if a sports bet offers odds of 3.00 with a winning probability of 0.40 (and consequently a 0.60 chance of losing), the calculation would be:

\frac{(3 \times 0.40 – 0.60)}{3} = 0.20

]

This result means you should bet 20% of your bankroll on this event. Despite a higher likelihood of losing, the bet is strategically favorable due to its positive expected value, promising higher overall returns and lower losses in the long run.

Strategic Insights and Conclusion

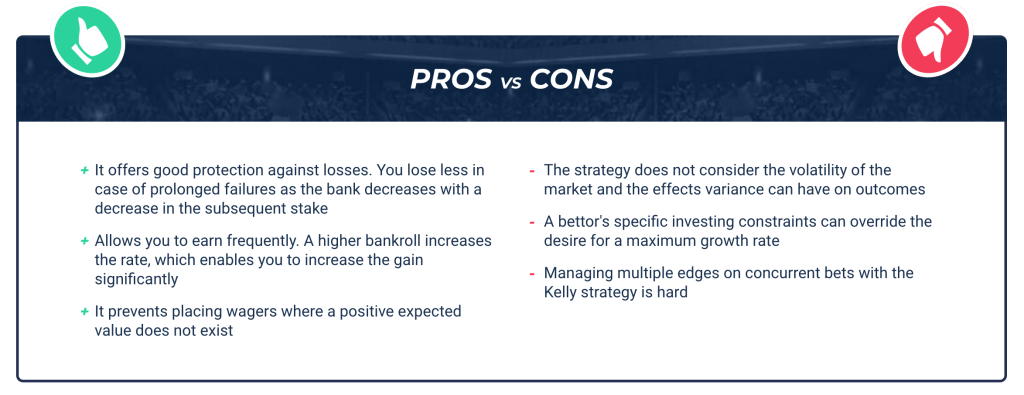

The Kelly strategy is invaluable for calculating the optimal bet size across various betting venues, including casinos, sports, and the stock market. Its major advantage lies in its lower-risk profile and its ability to secure profits over the long term, making it a superior choice compared to other staking methods. By incorporating modern modeling tools and sports analytics, the Kelly strategy can help identify value in the odds, guiding bettors on appropriate stake sizes to optimize their capital growth.

Kelly Criterion Betting System FAQ

❔ Who Was Kelly?

John Larry Kelly Jr. was an American scientist famed for his work at AT&T’s Bell Laboratories in New Jersey, where he developed the Kelly strategy from a system designed to analyze network-transmitted information. A veteran of World War II, Kelly served as a pilot in the US Navy before pursuing his education at the University of Texas at Austin, earning a Ph.D. in Physics in 1953.

🏆 Is the Kelly Criterion Betting Strategy Illegal?

No. The Kelly Criterion is entirely legal for use in betting and investing. As long as the gambling platform is legally operating, bettors can utilize this strategy without restrictions, limited only by their bankroll and the site’s maximum betting limits.

💶 Is the Kelly Criterion System Allowed in Bookmakers?

Yes. The Kelly Criterion is a recognized betting strategy that is permissible at any bookmaker. It is designed to help manage bets effectively, limiting losses and maximizing gains.

💳 Is Kelly’s Criterion a Safe Method for Betting?

The Kelly strategy is considered a safe and effective money management tool in both betting and investing. It is widely used by investors and sports bettors alike, including notable figures such as Warren Buffet, Charlie Munger, and Bill Gross of Berkshire Hathaway, for its ability to optimize staking plans and enhance financial growth.

🤔 Can I Bet on Football with The Kelly Criterion Formula?

Absolutely. The Kelly strategy is suitable for nearly all forms of gambling, including football betting. It’s highly regarded in sports betting circles for its potential to yield higher profits compared to other betting strategies, making it a top choice for football bettors seeking to maximize their betting efficiency and profitability.